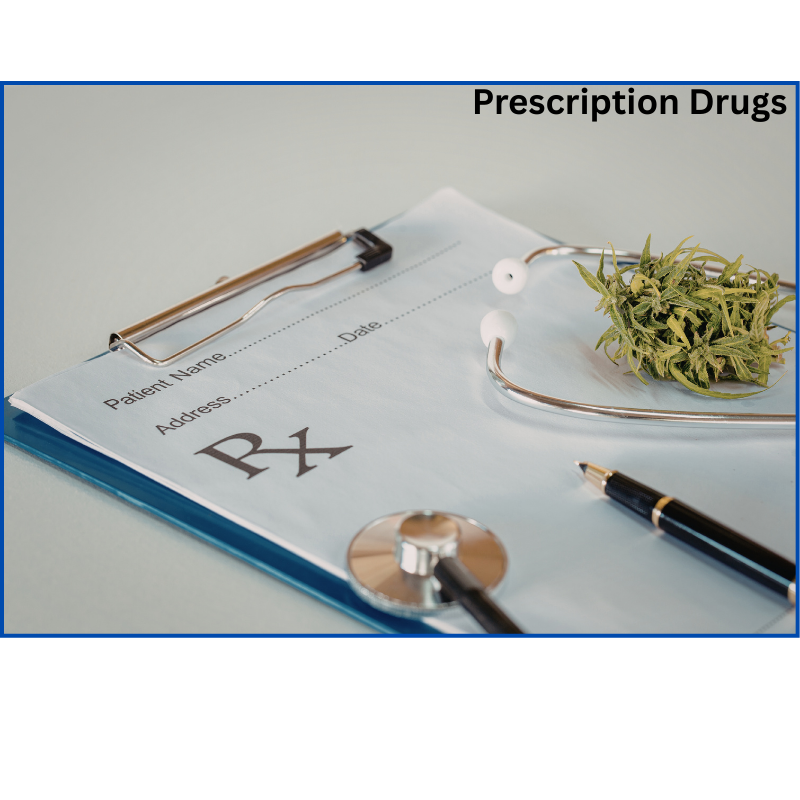

Medical & Dental Coverage—When Government Care Isn’t Enough

Prescription drugs, dental care, vision, and paramedical services aren’t fully covered by provincial healthcare. We help you choose a plan that fits your life—with clarity and expert guidance.

Check My Options (2-Minute Quiz)

Why Health & Dental Insurance Matters

Many Canadians are surprised to learn that government healthcare does not cover everyday health expenses like prescriptions, dental visits, or physiotherapy. These costs can add up quickly—especially for families, self-employed individuals, and those without workplace benefits.

Health & Dental insurance helps protect both your health and your cash flow.

What You Can Cover

Prescription medications

Dental care (basic & major)

Vision care

Paramedical services (physio, massage, psychology)

Hospital and extended health benefits

Optional Travel medical insurance

Coverage varies by plan. We help you understand what’s included—and what’s not.

Is This Right for You?

Leaving or recently left employer benefits

Self-employed or a contractor

Retired or semi-retired

A newcomer to Canada

Supporting a family without group coverage

How It Works

Answer a few quick questions

We narrow down suitable options

An advisor reviews them with you

Apply with confidence—no guesswork

Find the Health & Dental Coverage That Fits You

Find the right coverage in 2 minutes

Answer a few quick questions and we’ll recommend the best next step. No pressure. No guesswork.

Your Coverage Snapshot

Book a 15-minute call

Why Work With Britanico?

Unlike direct-to-consumer insurance websites, we:

Compare options objectively

Explain limits, exclusions, and trade-offs clearly

Support you before and after approval

Stay with you as your needs evolve

Insurance isn’t just a purchase—it’s an ongoing decision.

Coverage is subject to eligibility, underwriting (where applicable), and insurer approval.

We respect your privacy and protect your personal information.