Protect Your Income. Protect Your Lifestyle.

Your ability to earn an income is one of your most valuable assets. Acci-Jet is designed to protect that income if an accident—or illness—prevents you from working.

-

Acci-Jet provides disability income protection with flexible options tailored to your work and lifestyle.

Monthly income replacement benefits

Coverage for accidents and soft-tissue injuries

Optional coverage in case of illness

Benefit periods of 2 years, 5 years, or up to age 70

Optional business overhead expense coverage

Benefits are generally non-taxable when personally paid, helping maintain financial stability during recovery.

-

Income protection of up to 70% of earnings

No medical exam for accident coverage

Customizable benefit amounts and durations

Designed for professionals, business owners, and self-employed individuals

Optional riders for enhanced protection

-

Self-employed professionals and business owners

Employees without adequate group disability coverage

Individuals with income tied directly to their ability to work

Those seeking stronger income replacement than basic accident plans

How Acci-Jet Fits into a Financial Plan

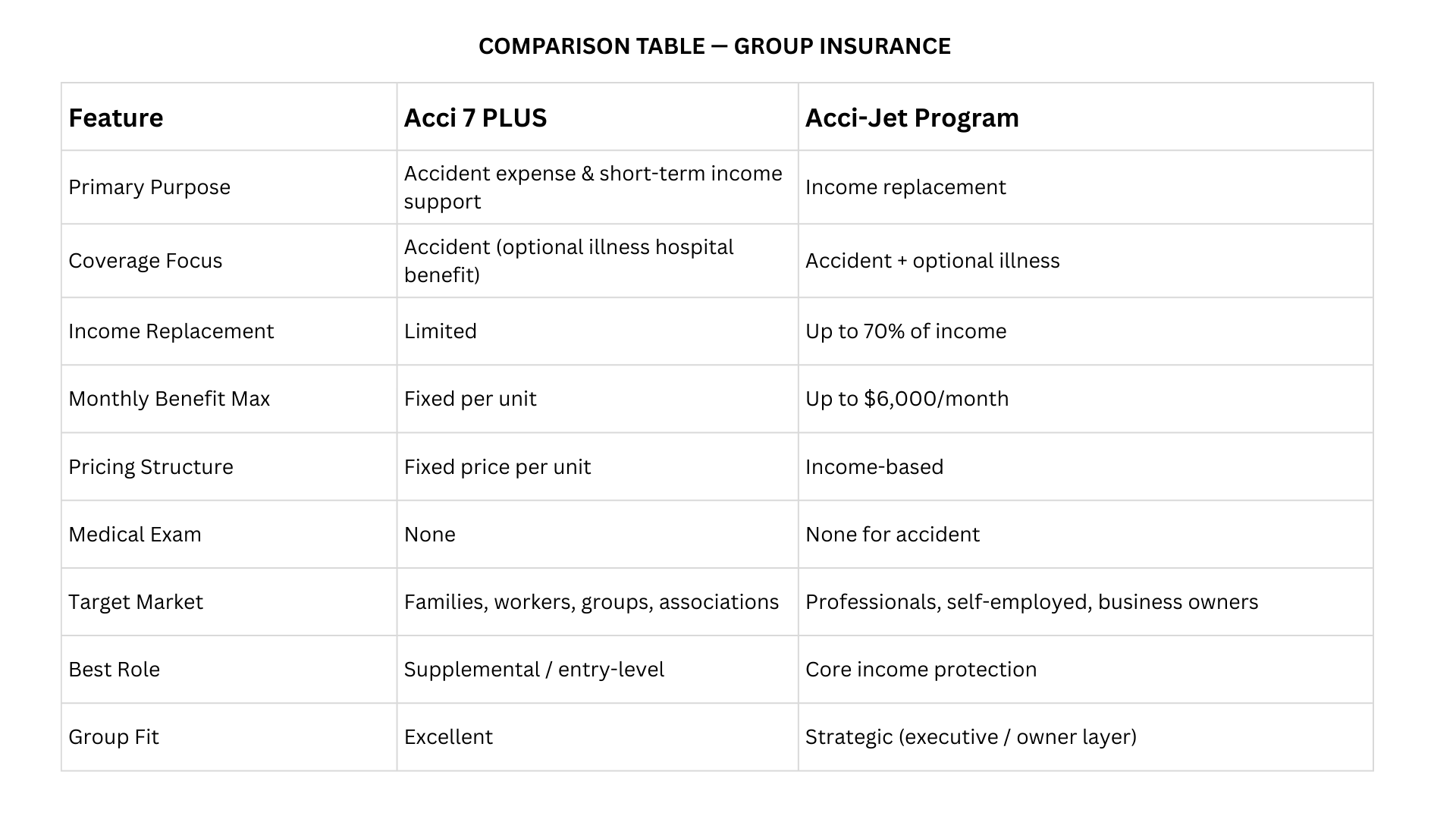

Acci-Jet focuses on income continuity. It is often used as a core disability solution or layered with group insurance to close income gaps.